Submitted by David Weisbrod, Democratic member of the Greenwich Board of Estimation and Taxation (BET)

If you are reading these words right now, chances are good that you have observed some concerning cracks in how the Greenwich BET has been functioning of late.

The level of strife has grown to an unhealthy level. Community wellbeing is at risk unless leaders embrace a few fundamentals to improve BET performance. The good news is that nothing terribly radical is needed – just some common-sense changes. Here are some thoughts for consideration:

• Longer range financial planning for capital projects is essential. Capital financing projections have doubled in the last three years, with fifteen-year projections growing from $608million in FY 19 to $1,255million in the current fiscal year. This is mainly, but not entirely due to inclusion of the Board of Ed’s Facilities Master Plan addressing long deferred structural needs of our aging school infrastructure. All of this points to the need to establish capital priorities by reviving the Capital Improvement Program Projects Committee with active engagement from both the First Selectman and the Superintendent of Schools. We must demand more cross-silo coordination, recognizing that the BET is where competing needs get resolved and included in a budget.

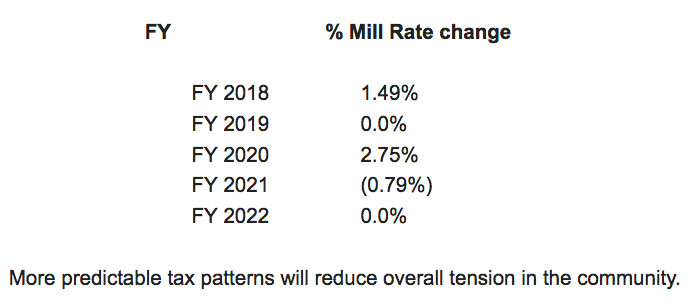

• Mill rate changes should be maintained as nearly constant as possible. In years past,the BET adopted a budget approach that raised the mill rate a predictable amount to ensure steady funding of capital projects and salary increases mandated by labor contract terms. We now have a hurky-jerky approach to mill rate changes, as the table below evidences:

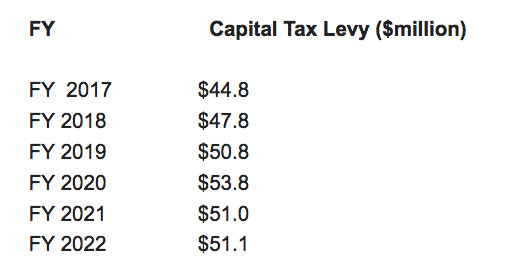

• Capital project funding should be sustained on a reliable basis. Under the Town’s “Modified Pay as You Go” program, a substantial portion of capital project funding is derived from the capital tax levy, funded from property taxes. In previous years, the annual contribution from tax revenues increased by $3million p.a. to ensure adequate stockpiling of funds to cover growing capital needs in the community (as pointed out above, these needs have roughly doubled in the past three years). The following table shows that in the past two years capital tax funding has not grown as it had in years past. Essentially, what you have is a “Pay as You Go” program without the “Pay” component needed to meet known needs:

Essentially what the two tables in combination portray is that in the past two fiscal years, despite a doubling of anticipated capital expenditures, the well-established capital funding pattern was curtailed simply to provide reduction in current taxes.

That is Greenwich’s version of the Hartford failure to fund pension requirements that over time ballooned to a major fiscal problem in the State.

• Realistic assessments of residents’ financial condition must be made

In FY 21, the BET assessment of the impact of COVID to Town residents, turned out to be too-Draconian, contributing perhaps to some of the abrupt changes in funding patterns as described above. Most commentators today would describe Greenwich as part of a “K” shaped recovery, with sharply improving economic improvements benefitting us. By many measures, Greenwich is now better off than it was two years ago, pre-COVID. For example, commercial real estate in Greenwich is said to be one of a small handful of places in the U.S. that actually benefitted from the pandemic, with office vacancy rates falling and rents rising.

The point here is not to gloat over Greenwich wealth, but to recognize that conditions must be assessed in such a way to preserve a balanced, predictable, steady hand on the tiller.

• Let’s be smart about how to apply funds from the American Rescue Plan (ARP)

From a fiscal perspective, we have some wind at our back, thanks to the ARP. The Town is receiving $32.8million with an additional $10 million headed to the Schools. These are substantial sums and if used strategically will help us address a number of the unanswered needs, for example, improvement of HVAC in schools, that would otherwise have imposed budget challenges.

In conclusion, to make the Greenwich BET work as it should does not require heavy burdens, or even higher tax demands on our residents, but does require some reform about how we traditionally have done the business of setting budgets and tax rates in our Town. Collaborative leadership is achievable and will be beneficial to everyone in the community.

Note: The deadline for letters to the editor for candidates in the Nov 2, 2021 election is Oct 26, 2021 at 5:00pm (one week before election)

Note: Not every letter submitted will be published. We will select a few each week.

Instructions:

Send text of letter for consideration into the body of an email to [email protected] – not as an attachment.

Include your name and contact information. (Only your name will be published).