Letter to the editor from Michael Spilo, RTM District 11

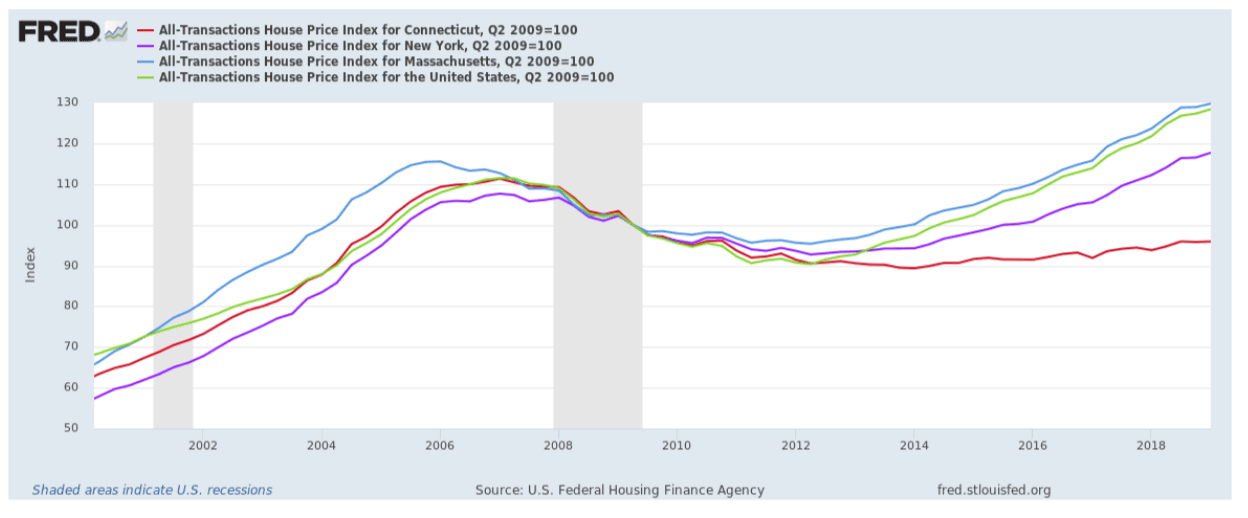

Connecticut homeowners should be very unhappy. Years of bad government policy have left us poorer. Literally. Property values in the state are 4% lower than they were in 2009 at the end of the Great Recession.

Since 2009, the national average home price (green line below) gained a whopping 28.4%, while CT prices (red) have dropped 4.1%, a 32.5% difference.

https://fred.stlouisfed.org/graph/?g=owBL Economic Research Federal Reserve Bank of St Louis. Source: US Federal Housing Finance Agency

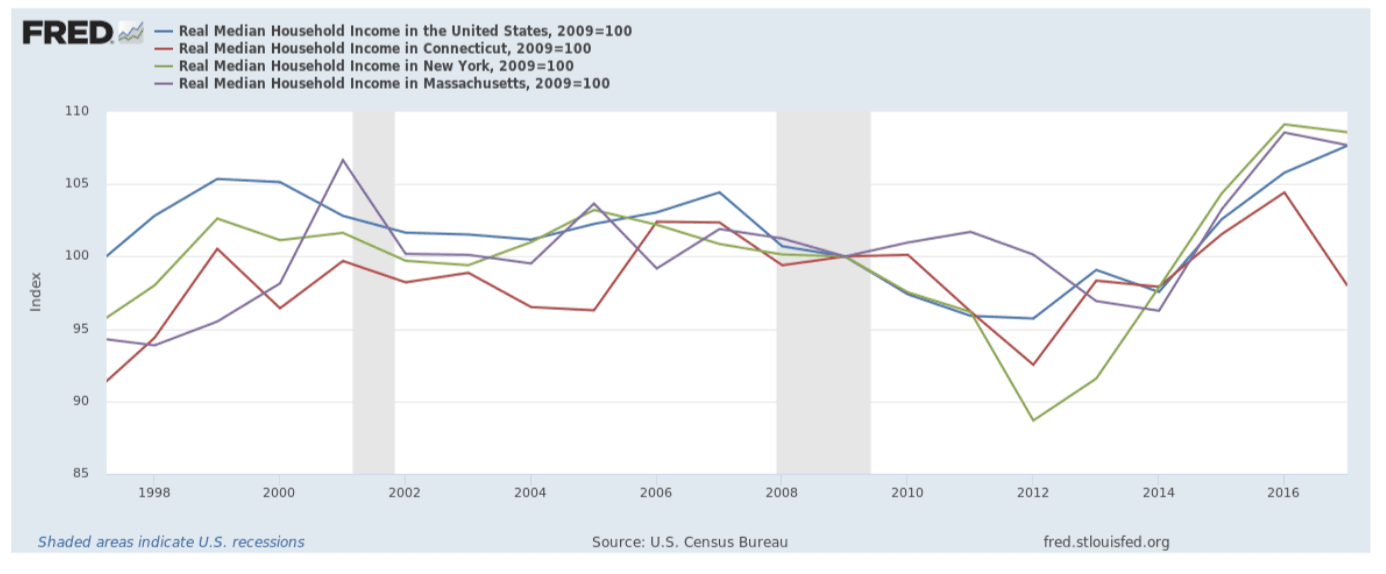

You might think that CT homes were highly over-priced before the recession, but not so. In fact, between 1991 and 2009, the U.S. average, NY and CT housing markets moved largely in tandem. But since 2009, NY homes have risen 18%, and MA 30%, in line with the national average, while CT homes have lost 4.1% of their value.

According to Zillow, the median home price in Connecticut is $224K (the national median is $200k, NY $300k, MA $400k). This means that relative to the rest of the U.S., the average CT homeowner has missed out on $110,000 in appreciation. In Fairfield county the median home price is over $700,000 which means the “Lost Decade” has cost Fairfield county homeowners $300,000 each.

68% of CT Residents are homeowners, and the CT median income is just under $70,000, which makes the lost appreciation is equivalent to well over year’s salary, before tax.

On a state-wide basis, there are 814,000 single family homes, so CT has missed out on $90 Billion in home appreciation and over $2 Billion in associated tax revenues.

What does this mean to you? if you moved to CT before 2009, divide your current home value by three. That’s about how much more your home would be worth if you lived outside CT. Even if you moved to CT after 2014, you missed out on an average 10% appreciation relative to New York Residents.

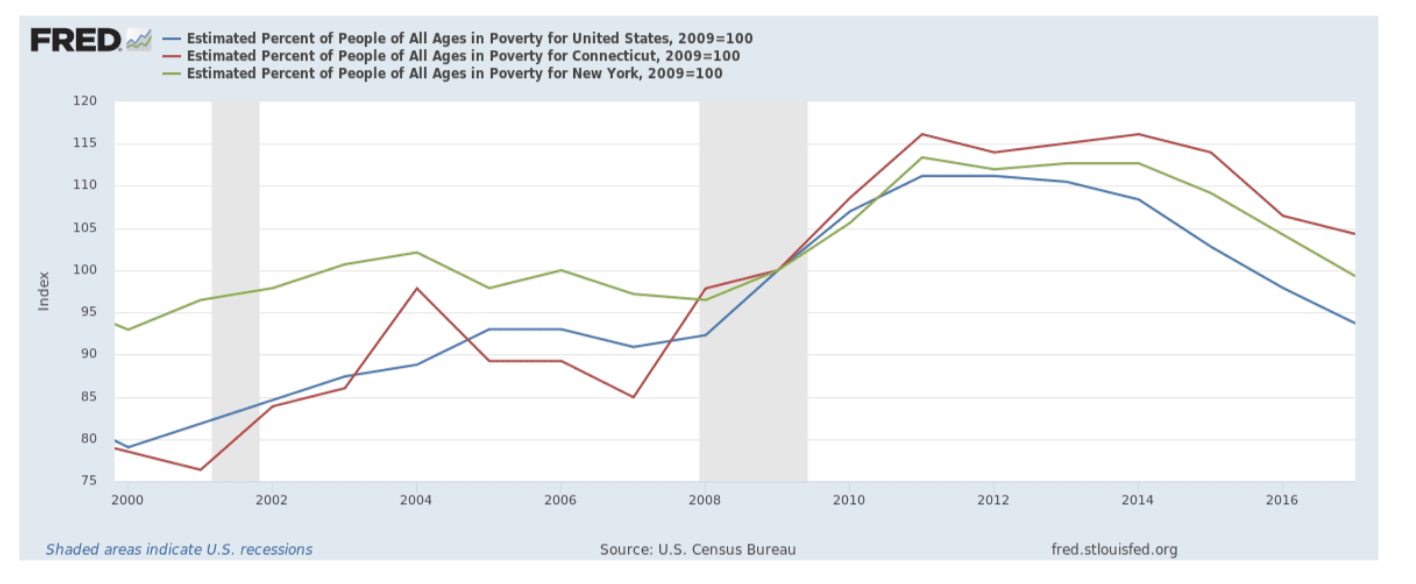

But “what did we gain?” Is Connecticut better off? Do we lead the country in some measure? For example, CT has low poverty rates, but has CT done a better job helping our poor than the rest of the country? No. CT has 4% MORE people in poverty than in 2009, whereas the U.S. has 6% fewer.

https://fred.stlouisfed.org/graph/?g=otxU Economic Research Federal Reserve Bank of St Louis. Source: US Census Bureau