Governor Ned Lamont announced that as of Thursday afternoon, a total of 200,027 households on behalf of 311,513 children had submitted applications for the 2022 Connecticut Child Tax Rebate.

This included more than 11,000 households that applied in the previous 24 hours.

The increase in applications over the last several days comes as the July 31, 2022, deadline to apply for the rebate quickly approaches.

Created as part of the budget bill that the governor signed into law this spring, the initiative is providing taxpayers with a state tax rebate of up to $250 per child for a maximum of three children. Any Connecticut resident who claimed at least one dependent child 18 years old or younger on their 2021 federal income tax return may be eligible.

State law requires the application period to close on July 31, 2022.

To apply, visit portal.ct.gov/DRS and click the icon that says “2022 CT Child Tax Rebate.”

“There are only a couple of days left to apply for this state tax rebate, and I strongly urge all families who claimed at least one dependent child on their federal income tax return to submit an application as soon as possible,” Governor Lamont said.

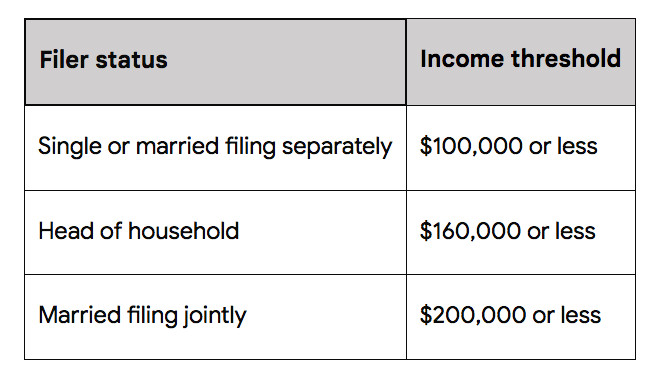

To receive the maximum rebate of $250 per child (for up to three children), the following income guidelines must be met:

Those who have higher income rates may be eligible to receive a reduced rebate based on their income.

Rebates will be sent to qualified recipients beginning in late August.

The Department of Revenue Services this week mailed a second set of informational postcards to more than 300,000 households that may meet eligibility requirements. The postcards contain instructions on how to apply for the rebate. The first set of postcards were mailed to these households in May.